DEMOFinancial Services30Countries1K+Trained Staff2016First Deployment3Awards

One of Australia’s major banks leveraged adaptive learning technology to deliver more effective and relevant risk training to its global workforce.

Please Note: This activity is a portion of a larger lesson. It is optimized for desktop use — we recommend viewing full-screen.

Intro

The Australia and New Zealand Banking Group (ANZ) is one of Australia’s four major banks. It operates in more than 30 countries globally and employs 50,000 staff. To ensure their employees understand the changing laws and regulations governing the financial services industry, banks need to provide relevant training courses. To enhance its existing online offering the Institutional Operations team sought to develop a scalable learning experience that could more effectively train its global workforce, complete with content tailored to specific business processes and geographies. ANZ partnered with Smart Sparrow to design an interactive and gamified learning module around operational risk that complements existing operations excellence training and complies with the Australia and New Zealand Banking Group Operational Risk Framework.

Challenge

One area of training vitally important for a multinational bank is around risk. Siva Navaratnam, Head of Operational Risk Assurance, Institutional & Retail Asia, is responsible for training more than 1500 employees across a range of different business units and geographic locations.

The department’s previous elearning solution used mostly static content, such as slides and multiple choice quizzes, which made it unengaging. It also took the approach of the lowest possible denominator to ensure the material was generic enough for the masses. In addition, the old platform offered course administrators no insight into how their staff were performing beyond a simple pass/fail outcome, making it difficult to identify areas of weakness or improve the delivery.

ANZ wanted to develop an interactive learning module that made training more fun, engaging and challenging for staff, featuring questions that were tailored to different roles and levels of expertise. They also wanted a platform with deep analytics, to measure the engagement and progress of individual staff members.

Finally, the bank needed this learning module to be scalable to other countries and business lines in the ANZ global network, as well as flexible enough to cater to the rapidly changing regulatory and technological environment that banks operate within.

SOLUTION

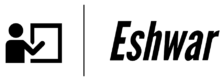

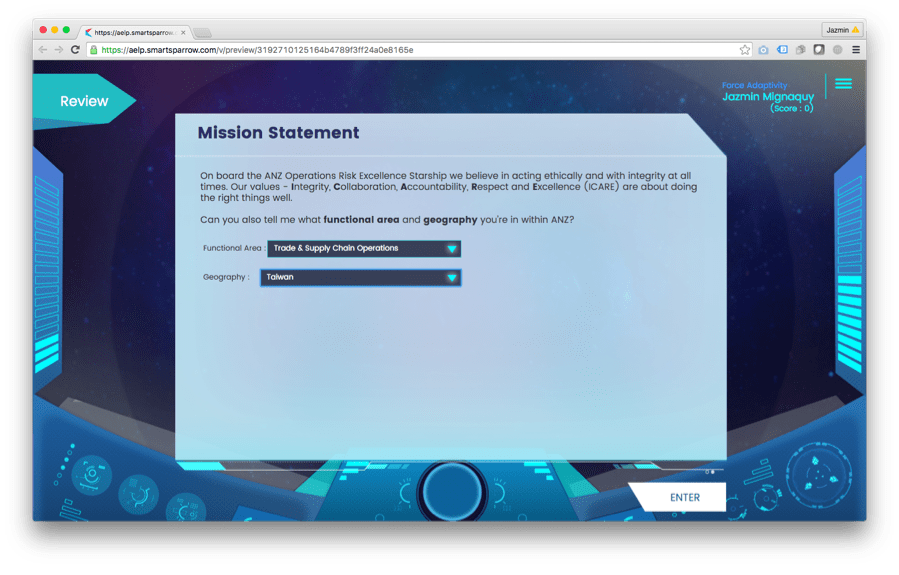

Working with Smart Sparrow’s Learning Design Studio, ANZ has developed a gamified operational risk training lesson tailored for the Institutional Operations function. To make learning engaging and motivating the learning design team built the module around a space exploration narrative structuring the training as a “space mission” to identify Operational Risks in the “ANZ Risk Universe”. Gamification elements, were incorporated such as simulations and medals at the completion of each sub-module, which enhanced the “mission” concept.

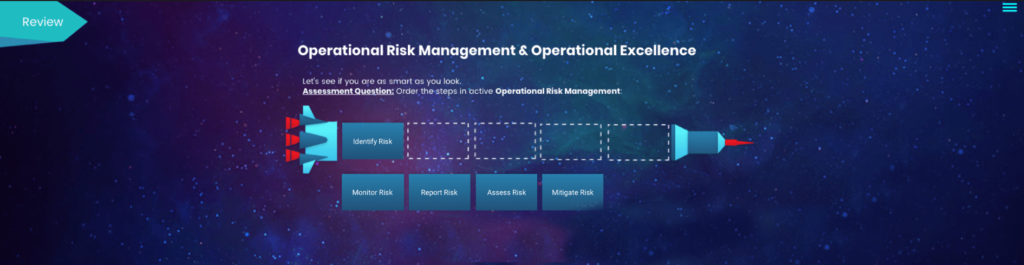

Employees learn the ANZ mission statement

As employees navigate through the fictional universe, they answer questions about risk and are taken through different learning pathways, which are unique to the learner depending on the business unit they work in. The adaptive nature of the module means that ANZ can customise learning content and tailor it for different business units, geographies and learning styles. The ability for ANZ instructors to modify content in real time is a significant upgrade over previous training programs, where changes often took months to complete and required numerous sign-offs.

With the new module, administrators also get unprecedented data about the performance and engagement levels of individual ANZ employees. Detailed learner analytics allow Mr. Navaratnam to better support at-risk or unengaged learners, whole teams or even an entire geography. ANZ can now identify early on who is struggling and under-performing in the module and develop a tailored support program. By identifying areas of weakness, instructors can improve the training, notify relevant managers if staff are underperforming, and arrange for additional learning activities and coaching.

Results

The training was delivered fully online and the module integrated seamlessly with the Bank’s existing LMS. The bank is considering using the module as a “gateway” for promotion and a tool for developing internal knowledge and competency standards around risk.

Awards

- “Best eLearning Model: Online” Gold in LearnX Impact Awards 2016, for its innovative learning design and pedagogical approach for a fully online delivery.

- “Best in Advance Content Authoring” Gold in Brandon Hall Group HCM Excellence in Technology Awards 2016

- “Best Use of Technology for Learning” 2nd place in AITD Excellence Awards 2016